MOWBRAY College has failed in its attempts to seek financial support and could enter voluntary administration.

Funding sought from the state or federal government has been unsuccessful according to a statement from the board.

Last night, college board chairperson, Tracey MacKenzie, during a meeting with parents and staff, said that the college had a debt of more than $18million.

In a statement Ms MacKenzie said that emergency funding of $4million was needed to continue to operate until the end of the year otherwise the board “would have to consider entering into voluntary administration”.

In an effort to make the college viable, the college will consider closing the Patterson campus in Melton and consolidating the Town Centre and Brookside campuses in Caroline Springs.

Mowbray’s vulnerable financial circumstances were recognised as early as 2009 after an independent audit commissioned by the Australian Securities and Investments Commission (ASIC).

The Weekly has obtained copies of the ASIC financial statement and report for 2009 for Mowbray College which concluded that while the board had provided a true and fair view of it’s financial position: “The college is reliant on the enrolment income and the continued financial support of its bankers to continue to operate … . Should this supper be withdrawn or enrolment income decline rapidly then there is a significant uncertainty whether the college will realise its assets and extinguish its liabilities in the normal course of business”‘.

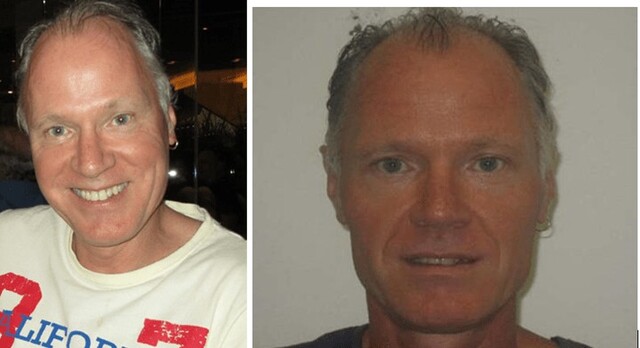

In April the then principal Tony Keirsten-Wakefield told the Weekly that Mowbray, which this year cost from $6460 to $9727 in compulsory fees and levies to attend, was in financial difficulty.

“Maintaining buildings that are 30 years old and the reduction in enrolment exacerbates that,” Mr Keirsten-Wakefield said.

About 65 per cent of students travelled to Patterson campus by bus from areas as far out as Bacchus Marsh, Williamstown, Point Cook and Riddells Creek.